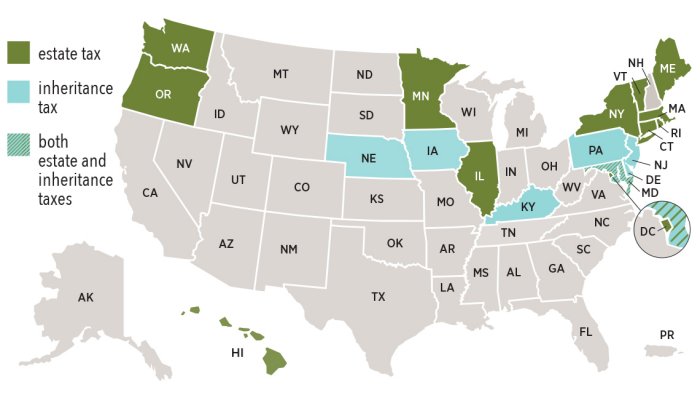

17 States With Estate or Inheritance Taxes

Even if you are able to escape the federal estate tax, these states may get you.

Most people don’t have to worry about the federal estate tax, which excludesup to $11.58 million for individuals and $23.16 million for married couples in the 2020 tax year. But 17 states and the District of Columbia may tax your estate, an inheritance or both, according to the Tax Foundation.

Eleven states have only an estate tax: Connecticut, Hawaii, Illinois,

Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island,

Vermont and Washington. Washington, D.C. does, as well. Estate taxes are

levied on the value of a decedent’s assets after debts have been paid.

Maine, for example, levies no tax the first $5.7 million of an estate

and taxes amounts above that at a rate of 8 percent to a maximum 12

percent.

Iowa, Kentucky, Nebraska, New Jersey, Pennsylvania and Rhode Island

have only an inheritance tax — that is, a tax on what you receive as the

beneficiary of an estate. Kentucky, for example, taxes inheritances at

up to 16 percent. Spouses and certain other heirs are typically excluded

by states from paying inheritance taxes.

Maryland is the lone state that levies both an inheritance tax and an estate tax.

2020 state levies on estates, inheritances or both

- Connecticut: Estate tax of 10 percent to 12 percent on estates above $5.1 million

- District of Columbia: Estate tax of 12 percent to 16 percent on estates above $5.8 million

- Hawaii: Estate tax of 10 percent to 20 percent on estates above $5.5 million

- Illinois: Estate tax of 0.8 percent to 16 percent on estates above $4 million

- Iowa: Inheritance tax of up to 15 percent

- Kentucky: Inheritance tax of up to 16 percent

- Maine: Estate tax of 8 percent to 12 percent on estates above $5.7 million

- Maryland: Estate tax of 0.8 percent to 16 percent on estates above $5 million; inheritance tax of up to 10 percent

- Massachusetts: 0.8 percent to 16 percent on estates above $1 million

- Minnesota: 13 percent to 16 percent on estates above $3 million

- Nebraska: Inheritance tax of up to 18 percent

- New Jersey: Inheritance tax of up to 16 percent

- New York: Estate tax of 3.06 percent to 16 percent for estates above $5.9 million

- Oregon: Estate tax of 10 percent to 16 percent on estates above $1 million

- Pennsylvania: Inheritance tax of up to 15 percent

- Rhode Island: Estate tax of 0.8 percent to 16 percent on estates above $1.6 million

- Vermont: Estate tax of 16 percent on estates above $2.8 million

- Washington: Estate tax of 10 percent to 20 percent on estates above $2.2 million

Courtesy of AARP. by John Waggoner, October 5, 2020

#thehelpfulagent #pets #houseexpert #housing #home #move #realestate #realestateagent #home #househunting #forsale #newhome #dreamhome #familyhome #brianchandler #parkercolorado #realtor #realestate #realestateagent